- Macro Hedge

- Posts

- Macro Hedge

Macro Hedge

John Balafoutas | June 5th, 2023

💭 Quote of the Day

"The Fed is committed to bringing inflation back down to our 2% target, and we will continue to act expeditiously to do so."

Loretta Mester - CEO at the Federal Reserve Bank of Cleveland

What Really Matters

In the 1Q23, deposits rose Q/Q at Ally, Goldman Sachs's Marcus and Capital One. Meanwhile, deposits fell from December at regional-bank powerhouses such as U.S. Bank, Truist Financial and Citizens Financial.

This trend is likely to continue as consumers increasingly prefer the convenience and low fees of online banking

Two traders who have made billions of dollars betting on market crashes are warning of a "black swan" event in the years ahead.

Mark Spitznagel and Nassim Nicholas Taleb, who run the investment firm Universa Investments, say that the U.S. government is facing a "fiscal cliff" and that the debt ceiling could be the trigger for a market collapse

They are urging investors to prepare for the worst by hedging their bets

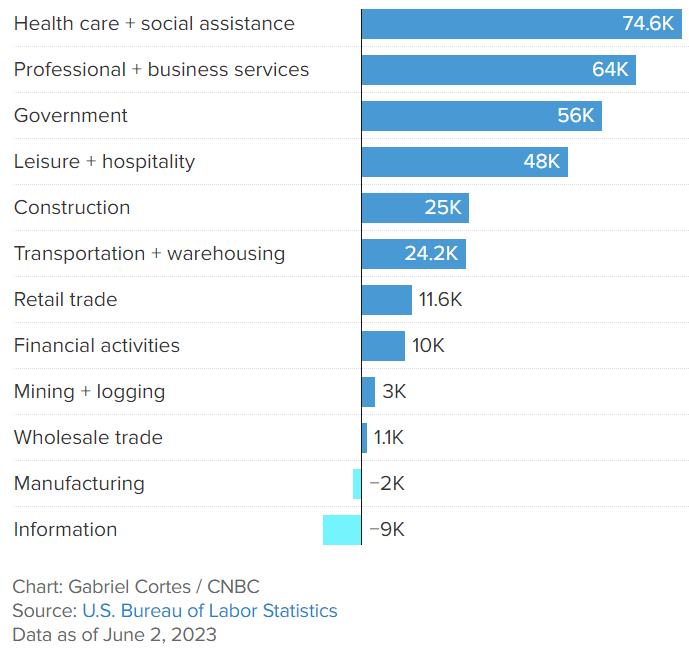

The U.S. added 339,000 jobs in May, beating expectations. The unemployment rate remained unchanged at 3.7%.

Job growth was broad-based, with gains in healthcare, professional and business services, and leisure and hospitality

This is the 29th consecutive month of job growth

May Jobs M/M Change

Market Movement

Amazon is reportedly planning to launch a wireless phone service that would be bundled with its Prime subscription.

The service would be a major threat to the traditional telecom companies, which have been losing customers to smaller, more nimble competitors

Amazon's entry into the wireless market could shake up the industry and lead to lower prices and better service for consumers

3M, Caterpillar, and other industrial stocks are in focus as investors look for defensive plays amid rising inflation and interest rates.

These stocks are seen as relatively immune to economic downturns and offer attractive dividend yields

📜 Personal Finance Quick FAQs

Q: How do I improve my credit score?

Now that you're out in the real world, it's time to start thinking about your credit score. A good credit score can help you get a car loan, a mortgage, or even a job. Here are a few tips on how to improve your credit score after college:

Get a credit card and use it responsibly. The first step to building credit is to get a credit card. When you use your credit card, make sure to pay your bill in full each month. This will help you avoid interest charges and build a positive payment history

Keep your credit utilization low. Your credit utilization is the percentage of your available credit that you're using. Aim to keep your credit utilization below 30%

Pay down debt. If you have any debt, such as student loans or credit card debt, make a plan to pay it down as quickly as possible. The less debt you have, the better your credit score will be

Check your credit report for errors. It's important to check your credit report for errors at least once a year. If you find any errors, dispute them immediately

Be patient. It takes time to build a good credit score. Don't get discouraged if you don't see results immediately. Just keep at it and you'll eventually reach your goal

Improving your credit score can seem daunting, but it's definitely possible. By following these tips, you can build a strong credit history that will serve you well for years to come.

Disclaimer: This newsletter provides general information and is not financial advice. It discusses current events and personal finance topics for educational purposes only. Consult a qualified financial advisor before making any financial decisions. The accuracy and timeliness of information cannot be guaranteed. Use this newsletter as a starting point for research, but conduct due diligence and seek professional guidance for your specific financial needs