- Macro Hedge

- Posts

- Macro Hedge

Macro Hedge

John Balafoutas | July 17th, 2023

Quote of the Day

—

“You have power over your mind — not outside events”

- Marcus Aurelius

The Big Idea

—

✈️ Soft Landing Still in Sight

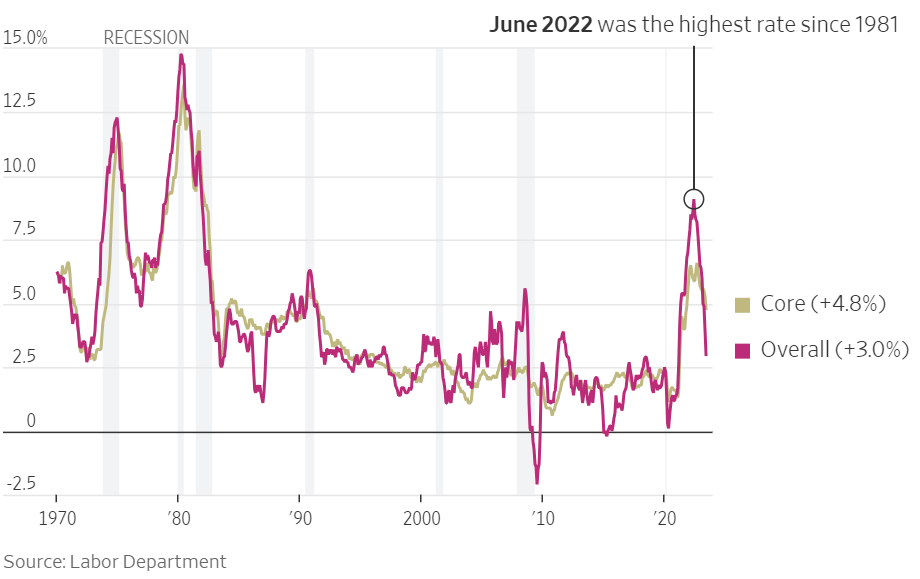

Why the optimism: Economic data released this past week pointed to a positive economic outlook and showed that the Fed’s actions are taking hold. the CPI, which tracks prices of everyday goods, showed the slowest Y/Y growth in over two years.

So what: The better than expected CPI report should ease investors’ fears around the rapid rise in interest rates caused by the Fed in hopes of reigning in inflation. Positive economic releases may not stop the Fed from raising in their July meeting, but does show promise that the rate hikes could come to an end sooner than expected.

Why do people hate long-term inflation: The longer it takes for the Fed to tame inflation, the more likely a recessionary outlook takes hold.

This is because as the Fed raised interest rates, the cost of borrowing money rises as well. This typically will slow down spending and hiring across consumers and businesses pointing to a downturn

But, wait: If the Fed is able to pull off a soft landing, the economy may be able to calm inflation without harming economic expansion.

Consumer Price Index, Y/Y Change:

Source: Wall Street Journal

Daily Scoop

—

🤝 Yellen Warms Up to China

Political limelight: Treasury Secretary Janet Yellen explained that the U.S. should work to “de-escalate” tensions with China, but also noted that it may still be too early to lift tariffs imposed during the Trump administration.

Comments at G20: “The tariffs were put in place because we had concern with unfair trade practices on China’s side — and our concerns with those practices remains,” she said. “So perhaps over time this is an area where we could make progress, but I would say it’s premature to use this as an area for de-escalation, at least at this time.”

Source: Bloomberg

—

🏦 Banks Fire Back at Barr

Regulatory backlash: Five bank trade groups outlined concerns to potential changes to bank capital requirements proposed by Michael Barr, the Fed’s Vice Chair for Supervision.

All five group called for regulators to give banks adequate time to comment on the recommendations, explaining that they would “have a profound effect on the U.S. banking system and U.S. capital markets,” which require “careful consideration”

Barr’s push: The pushback comes after Barr released a plan to significantly increase capital requirements for big banks’ to strengthen the ability of institutions to withstand shocks on their own and not require government bailouts.

Source: Bloomberg, Banking Dive

Brief Bullets

—

Currency Troubles: The U.S. central currency is flirting at its lowest level in more than a year after signs of cooling inflation point to the Fed halting rate hikes in the near future

Stock Market Faces Critical Test: A near $10T rally for global stocks this year will face a keystone moment as hundreds of companies report earnings over the next few weeks

Oil Surge: Crude surged above $80 per barrel in London last week as fuel demand in China and in other nations recover from the pandemic to reach new highs

David and Goliath: Carlos Alcaraz, the 20-year old Spaniard, beats Novak Djokovic to win his first Wimbledon title

Market Movement (YTD)

—