- Macro Hedge

- Posts

- Macro Hedge

Macro Hedge

John Balafoutas | July 19th, 2023

Quote of the Day

—

“We have two ears and one mouth, so we should listen more than we say.”

- Zeno of Citium

The Big Idea

—

🍃 Reading the Tea Leaves from Big Banks

So what’s happening: We are now in the midst of earning season, which has already been kicked off by some of the largest household name big banks. Last week JPMorgan, Citi, and Wells Fargo reported earnings colored by a surge of profits which paints a lovely picture compared to the dismal disaster which plagued the March banking crisis.

JPMorgan and Wells Fargo on Friday reported Y/Y net income growth of 67% and 57%, respectively, but the KBW Nadsaq Bank Index dropped more than 2% and shares of State Street, who also reported last week, fell 12%

Explain it to me: While bottom line numbers may have been rosy, investors are closely watching the numbers around deposits and deposit costs. Deposit costs jumped at all four banks that reported last week.

On average, the rates on interest-bearing deposits were around 20% higher in 2Q23 than they were in 1Q23. A slower pace increase than the rise from 4Q22 to 1Q23, but a rise nonetheless

High level thought: Jamie Dimon said it best when he explain that “there is very little pricing power in most of our business, and betas are going to go up.” Betas refer to how much of an increase in base interest rates banks choose to pass along to customers.

On the lookout: As regional banks begin reporting, deposit costs and deposit flows will be a key indicator for investors which may add some additional volatility to the market.

Source: Wall Street Journal

Daily Scoop

—

💵 More Americans Can’t Get Loans

Survey says: According to a recently released Fed survey, Americans are increasingly likely to get turned down when they apply for credit. This comes as a result to the combined impact of higher interest rates and a cautious turn among the country’s lenders.

The rejection rate for loan applications jumped to 21.8% in the 12 months through June, the highest level in five years, according to the Feds survey

Across auto loans, for the first time since 2013, when the survey began, the rejection rate climbed to 14.2% from 9.1%, exceeding the application rate

Source: Bloomberg

—

🔮 Recession? Goldman Says No

Wall Street’s take: Goldman Sachs’ Chief Economist Jan Hatzius said on Monday the bank was cutting it probability that a U.S. recession will start in the next 12 months to 20% from an earlier 25% forecast.

What did he say: "The main reason for our cut is that the recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession," Hatzius said in a research note.

Source: Reuters

—

✨ Wall Street’s Glimmer of Hope

From earnings: Bank of America, Morgan Stanley, JPMorgan, and Citi all beat analysts expectations for equity-underwriting revenue in the second quarter.

Morgan Stanley CFO Sharon Yeshaya explained that “It feels as though things are getting better and the signs are encouraging”

Now what: The positive news, along with strong gains and upbeat comments in some of the largest bank earnings calls, helped lift the shares of financial firms large and small. The KBW Bank Index climbed as much as 2.8% to its highest intraday level in three months.

Source: Bloomberg

Brief Bullets

—

Ford Fumbles: Ford cuts price of F-150 Lighting Electric Truck by up to $10,000 or 17%, the latest sign that swelling inventories and strong price competition are softening the market for the technology the auto industry is betting its future on

AT&Terrible: AT&T shares dropped to their lowest closing price in three decades, extending recent losses after the release of a WSJ investigation into toxic lead cables left behind by telecommunications companies

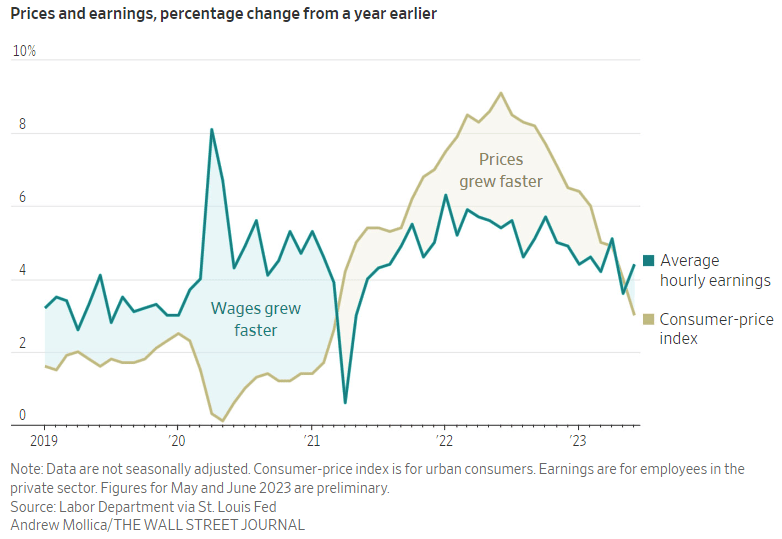

Pay Raise Beats Inflation: Americans’ growing paychecks surpassed inflation for the first time in two years, providing some financial relief to workers, while complicating the Fed’s efforts to tame price increases

Market Movement (YTD)

—

After Closing Bell - 07/18/2023