- Macro Hedge

- Posts

- Macro Hedge

Macro Hedge

John Balafoutas | June 21, 2023

💭 Quote of the Day

"The more you learn, the more you earn"

Benjamin Franklin

What Really Matters

What investors are saying: Investors are paying less for bonds linked to New York subways and buses causing downtown-focused REITs to trade at less than half their pre-pandemic levels.

In the past, downtowns have provided billions in tax revenue to investors, but now, with white-collar workers spending more time at home, investments linked to downtowns are losing value in volatile markets

Richard Ciccarone, president emeritus of Merritt Research Services, outlines that this could be a slow-motion change over time or the start of a slow-moving train wreck.

Office Occupancy as a % of Pre-Pandemic Occupancy

Driving the news: Binance, and Binance.US have entered into an agreement with the SEC to keep U.S. customer assets within the United States until a lawsuit filed this month by the regulatory agency is resolved.

The agreement, which still requires federal judge approval, aims at ensuring U.S. customer assets to not go offshore and allows only Binance.US employees to access these assets

Prior grievances: The SEC sued Binance and its CEO on June 5th, alleging that Binance artificially inflated its trading volumes, diverted customer funds, failed to restrict U.S. customers from its platform and misled investors about its internal controls.

Needed face lift: A group, led by SVB Securities CEO Jeff Leerink, will but SVB’s investment-banking business from its former parent company. The new firm, rebranded as Leerink Partners, will operate as an independent entity.

The buyers will pay $55 million bur the business and repay ~$26 million of SVB Financial Group’s debt. The buyers will also assume deferred bankers compensation liabilities and allow SVB Financial to keep 5% equity in the investment bank

The transaction is being backed by hedge fund Baupost Group and could receive court approval by the end of June

Jeff Leerink said that “the management team and I are excited to return to our heritage of owning and leading the premier healthcare investment bank and relaunching the business.”

Market Movements

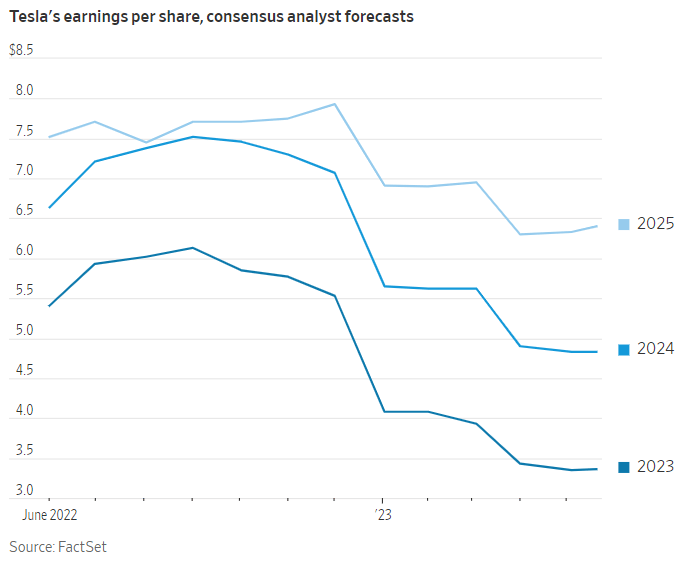

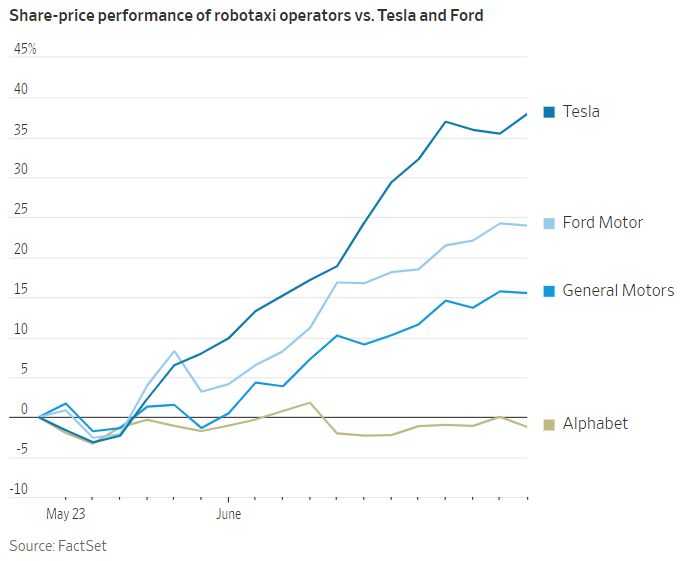

Tesla's stock price has soared in recent months, largely due to investors' enthusiasm for the company's self-driving technology. However, a new analysis by the Wall Street Journal suggests that Tesla's AI rally may be overblown.

The analysis, which uses eight charts, shows that Tesla's self-driving technology is still in its early stages and has a long way to go before it is ready for widespread use

For example, the charts show that Tesla's self-driving cars are still more likely to crash than human-driven cars, and that they are not yet able to handle complex driving scenarios, such as merging onto highways or navigating in heavy traffic

The analysis also shows that Tesla's competitors, such as Waymo and Uber, are making significant progress in the self-driving space. For example, Waymo's self-driving cars have already driven over 20 million miles on public roads, and Uber's self-driving cars are now being used in a limited commercial capacity in Pittsburgh

Select Charts from the Article

Personal Finance Quick FAQs

Q: What Does Transitory Inflation Mean?

Transitory Inflation

Transitory inflation is a temporary or short-lived increase in the rate at which consumer prices are rising in an economy. It is often caused by supply bottlenecks or other temporary factors that disrupt the normal flow of goods and services.

In 2021, the U.S. experienced a sharp increase in inflation. This was due to a number of factors, including the COVID-19 pandemic, the war in Ukraine, and supply chain disruptions. However, many economists believe that this inflation is transitory and that prices will eventually start to fall back down.

How Do We Know if Inflation is Transitory?

There are a few reasons why economists believe that inflation is transitory:

First, many of the factors that are causing inflation are temporary. For example, the COVID-19 pandemic was expected to end eventually, and supply chain disruptions were expected to be resolved

Second, the Federal Reserve is taking steps to combat inflation. The Fed has raised interest rates, and it is expected to continue to do so in the coming months. This will help to slow down the economy and reduce inflation

Of course, it is impossible to say for sure whether inflation is transitory or not. However, most economists believe that it is likely to be temporary. If you are concerned about inflation, you can take steps to protect your finances. For example, you can save money and invest in assets that are less sensitive to inflation, such as stocks and bonds.

Protecting Your Finances from Inflation

Save money in a high-yield savings account

Invest in assets that are less sensitive to inflation, such as stocks and bonds

Pay off high-interest debt

Make sure you have a budget and stick to it

Be prepared to make changes to your spending habits if inflation continues

Disclaimer: This newsletter provides general information and is not financial advice. It discusses current events and personal finance topics for educational purposes only. Consult a qualified financial advisor before making any financial decisions. The accuracy and timeliness of information cannot be guaranteed. Use this newsletter as a starting point for research, but conduct due diligence and seek professional guidance for your specific financial needs